全球教席“云课堂”24 讲

题目:交错任期董事会能改进公司价值吗?(Can Staggered Boards Improve Value?)

时间:2020 年 12 月 14 日(周一)10:00-12:00

腾讯会议 ID:937 238 982

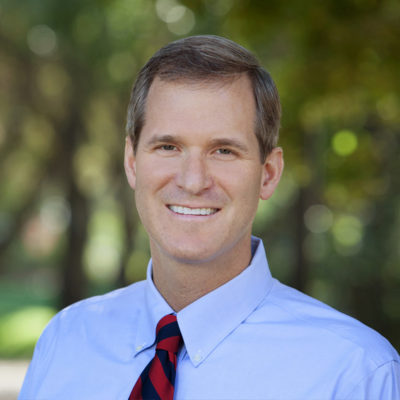

开讲学者:

Robert M. Daines(美国斯坦福大学3354cc金沙集团副院长、Pritzker 讲席法学教授、洛克公司治理研究中心高级研究员)

主持人:

邓峰(3354cc金沙集团教授)

开讲学者简介:

Robert M. Daines 教授重点研究法律与金融的交叉,包括 CEO 薪酬、公司治理、并购、强制性披露规定、IPO、股东投票和收购防御。Daines 教授的作品主要发表在《金融经济学期刊》《金融与定量分析期刊》《法律,经济与组织期刊》和《耶鲁法律期刊》等顶级刊物上。他的研究也被《经济学人》《纽约时报》《华尔街日报》《金融时报》《福布斯》和《财富》等杂志和媒体报道。在进入学术界之前,他曾是高盛的投资银行家,为银行和债券融资公司提供咨询服务。他也曾为美国第二巡回上诉法院的 Ralph K. Winter 法官担任法官助理。Daines 教授于 2012 年被授予 John Bingham Hurlbut 卓越教学奖。

Robert M. Daines is the Associate Dean,Pritzker Professor of Law and Business and Senior Faculty for the Rock Center on Corporate Governance at Stanford. He is also Professor of Finance (by courtesy) at the Stanford Graduate School of Business. His research focuses on the intersection between law and finance, including CEO pay, corporate governance, mergers and acquisitions, mandatory disclosure regulations, IPOs, shareholder voting and takeover defenses. Professor Daines’ work has appeared in such top publications as the Journal of Financial Economics, the Journal of Financial and Quantitative Analysis, the Journal of Law, Economics and Organization and The Yale Law Journal. His research has also been covered by The Economist, The New York Times, The Wall Street Journal, Financial Times, Forbes, Fortune and other media. Before entering academia, he was an investment banker at Goldman Sachs, where he advised firms on bank and bond financings. He clerked for Judge Ralph K. Winter of the U.S. Court of Appeals for the Second Circuit. Prof. Daines was awarded the 2012 John Bingham Hurlbut Award for Excellence in Teaching.

讲座摘要

本讲座将聚焦交错任期董事会对管理者行为和公司长期价值的影响。一项颁布于 1990 年的法律规定,所有在马萨诸塞州注册的公司都必须设立交错任期董事会。基于此进行的自然实验表明这部法律导致了托宾 Q 系数(股票市值与其背后资本重置的比值)的增长。此实验结果能够稳健地得到其他替代模型和理论的验证,并且其有效性在 IRRC(投资者责任研究中心)的其他样本中得到了支持。托宾 Q 系数增长的现象集中出现在那些处于早期生命周期或需要投入大量研发资金的创新型公司当中,尤其是那些始终被华尔街关注的公司。通过考察公司价值变化的机制,我们发现,交错任期董事会所提供的保护增加了资本支出和研发支出,并且产生了更多的专利技术,降低了盈余管理的程度。这样的现象在创新性公司中尤为显著。总体而言,上述证据可以表明,通过进行更有价值的长期投资并且减少短视的行为,从而建立对控制权市场的防范,进而公司可以从中获利。

This lecture will focus on the effect of staggered boards on managers’ behavior and on long-run firm value using a natural experiment: a 1990 law that imposed a staggered board on all firms incorporated in Massachusetts. We find that the law led to an increase in Tobin’s Q. These results are robust to alternative models and specifications, and are validated in the larger sample of firms covered by the Investor Responsibility Research Center (IRRC). The increase in Tobin’s Q is concentrated at innovating firms—those that are early-life-cycle or engage in R&D spending—and especially at those facing Wall Street scrutiny. Examining mechanisms for the change in firm value, we find that the protection afforded by a staggered board increased investment in capital expenditure and RD spending, produced more patents, and reduced the degree of earnings management, especially at innovating firms. Collectively, the evidence suggests that firms facing high information asymmetries benefit from protections against the market for corporate control by making more valuable long-term investments and reducing myopic behavior.